42 pension plan definition

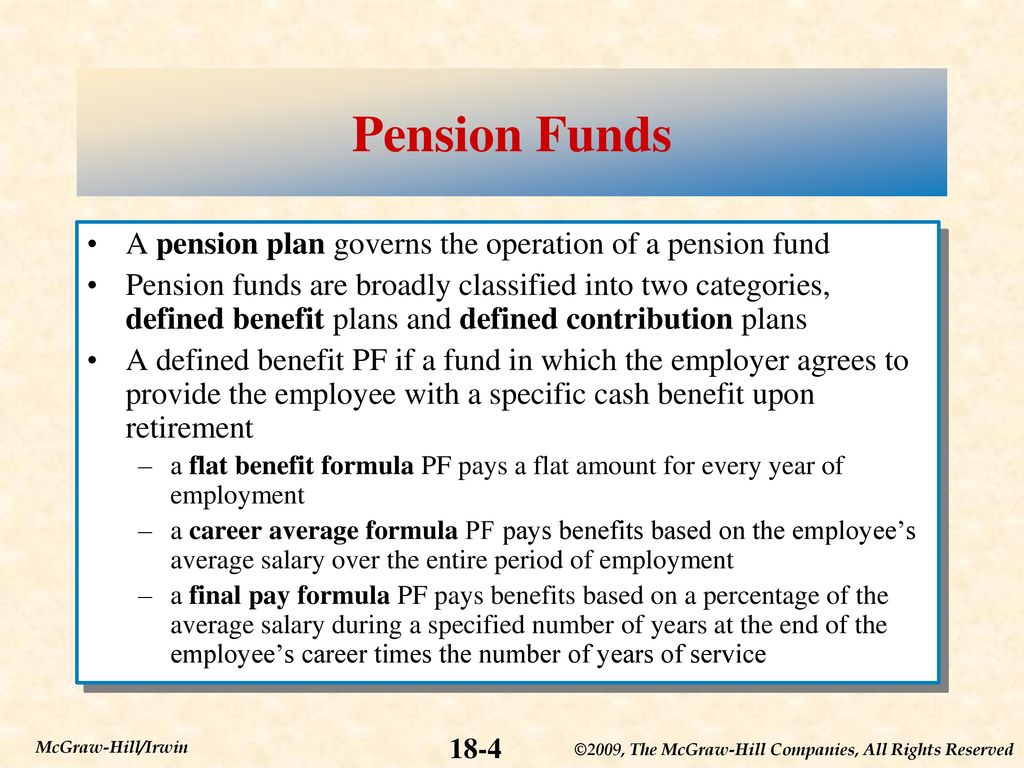

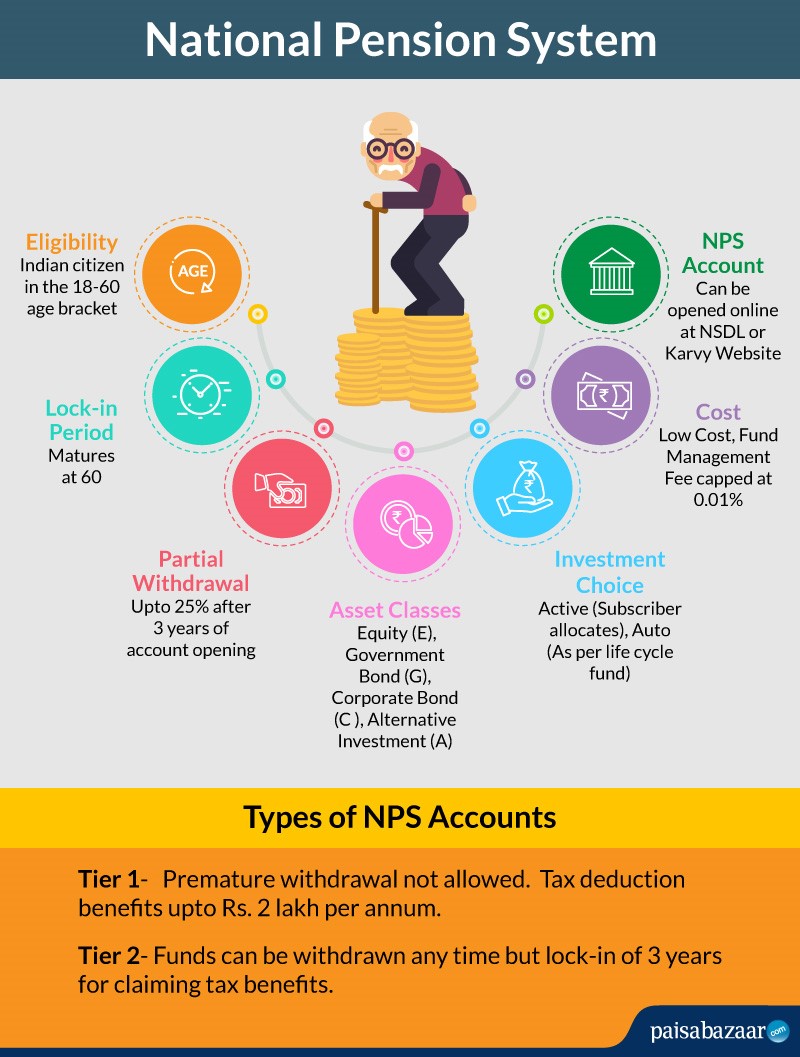

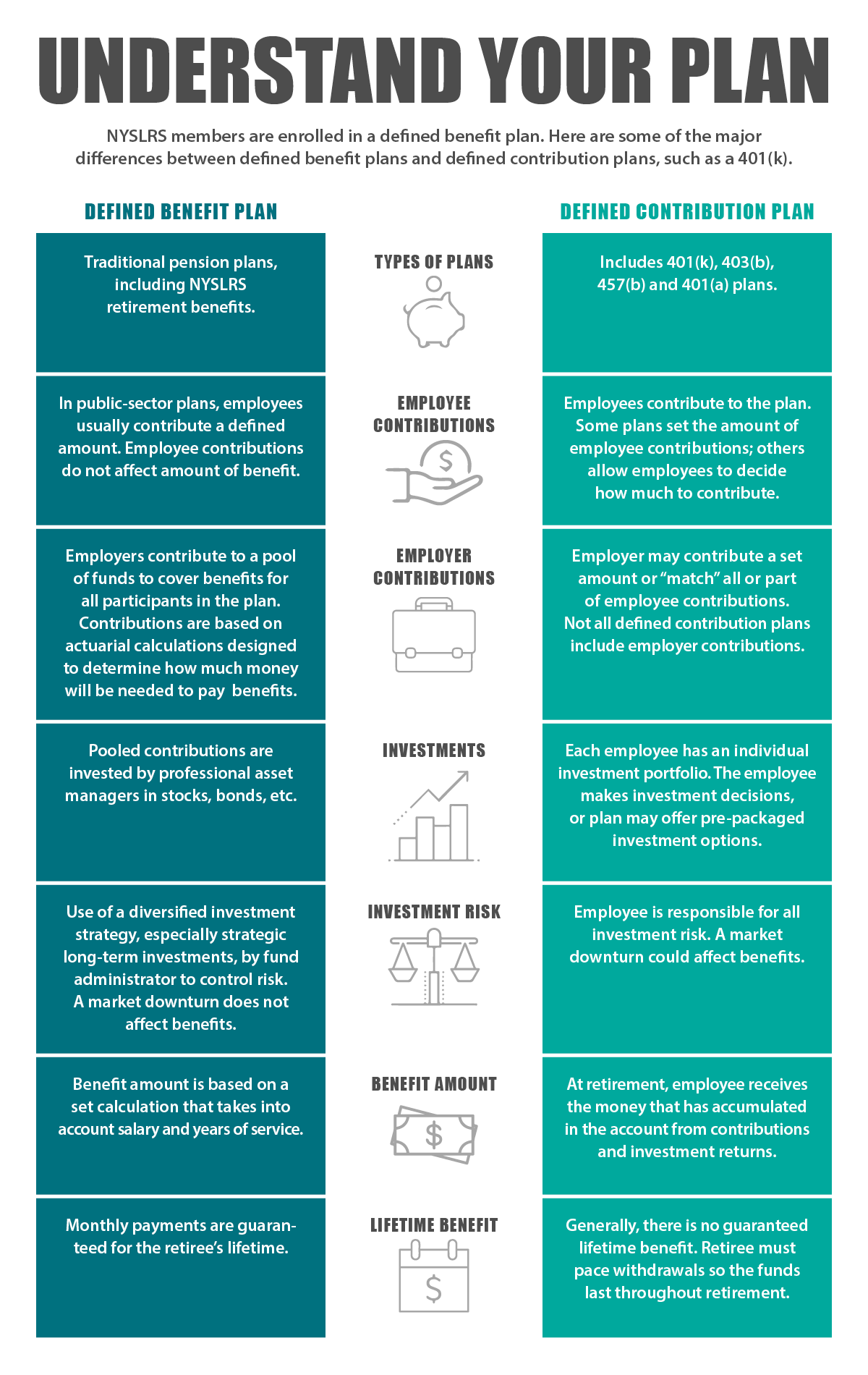

Pension Plan Definition A pension plan is an employee benefit that commits the employer to make regular contributions to a pool of money that is set aside in order to fund payments ...30 Aug 2021Defined Benefit vs. Defined Contribution: What Is the Difference?How Long Does it Take to Get Vested Under a Pension Plan? Pension fund - Wikipedia A pension fund, also known as a superannuation fund in some countries, is any plan, fund, or scheme which provides retirement income.. Pension funds typically have large amounts of money to invest and are the major investors in listed and private companies. They are especially important to the stock market where large institutional investors dominate.

Overfunded Pension Plan Definition 18.02.2021 · A pension plan that has a funding ratio of less than 100% means that it doesn't have enough funds to cover future liabilities or monthly benefits. A pension that's overfunded would have a funding ...

Pension plan definition

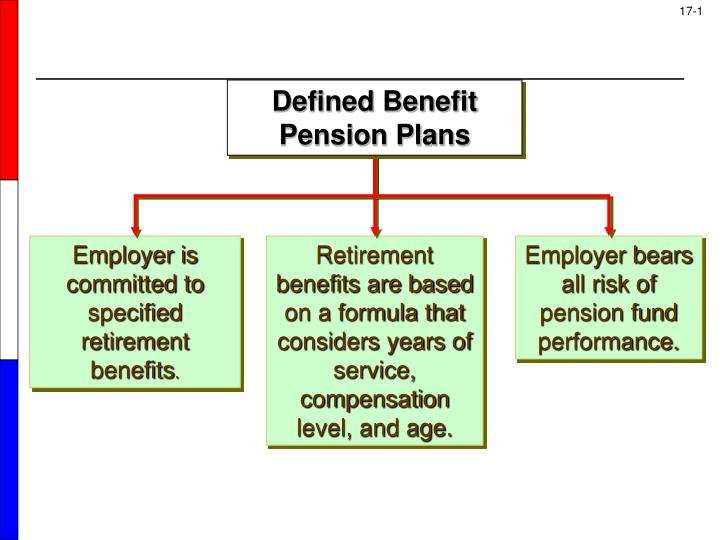

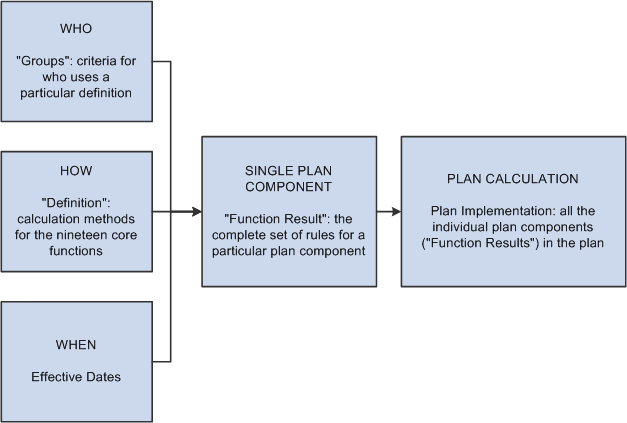

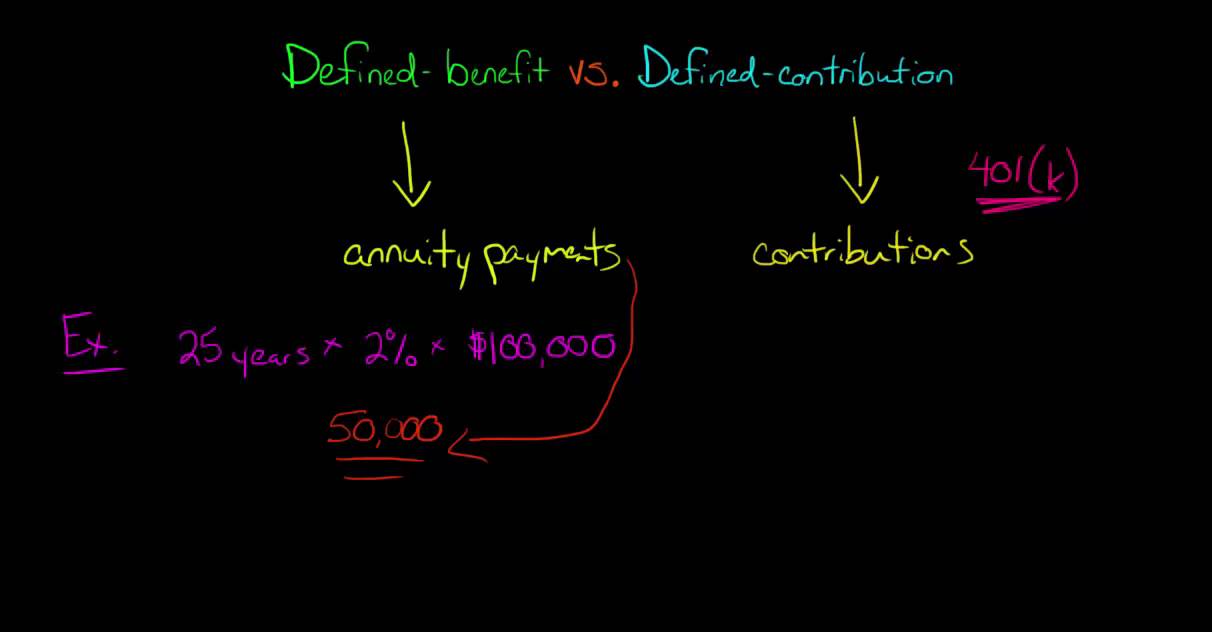

Publication 575 (2020), Pension and Annuity Income ... Under the pension plan, however, a formula determines the amount of the pension benefits. The amount of contributions is the amount necessary to provide that pension. Each plan is a separate program and a separate contract. If you get benefits from these plans, you must account for each separately, even though the benefits from both may be ... › article › investingPension Plan vs. 401(k): Types, Pros & Cons - NerdWallet Jan 12, 2022 · A pension plan is a retirement-savings plan typically funded by an employer. Money goes into the pension on behalf of the employee while the employee works for the organization. The employee ... › dictionary › pensionPension Definition & Meaning - Merriam-Webster pension: [noun] a fixed sum paid regularly to a person:. wage. a gratuity granted (as by a government) as a favor or reward. one paid under given conditions to a person following retirement from service or to surviving dependents.

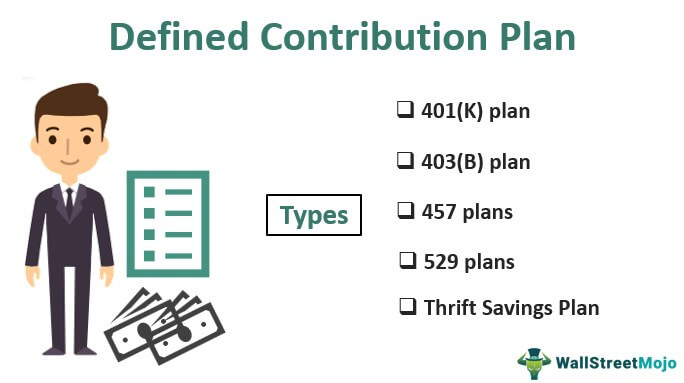

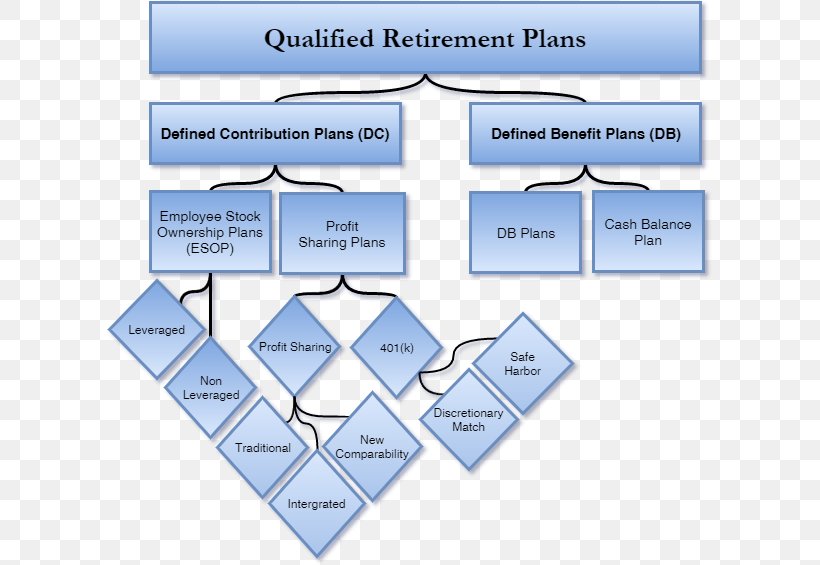

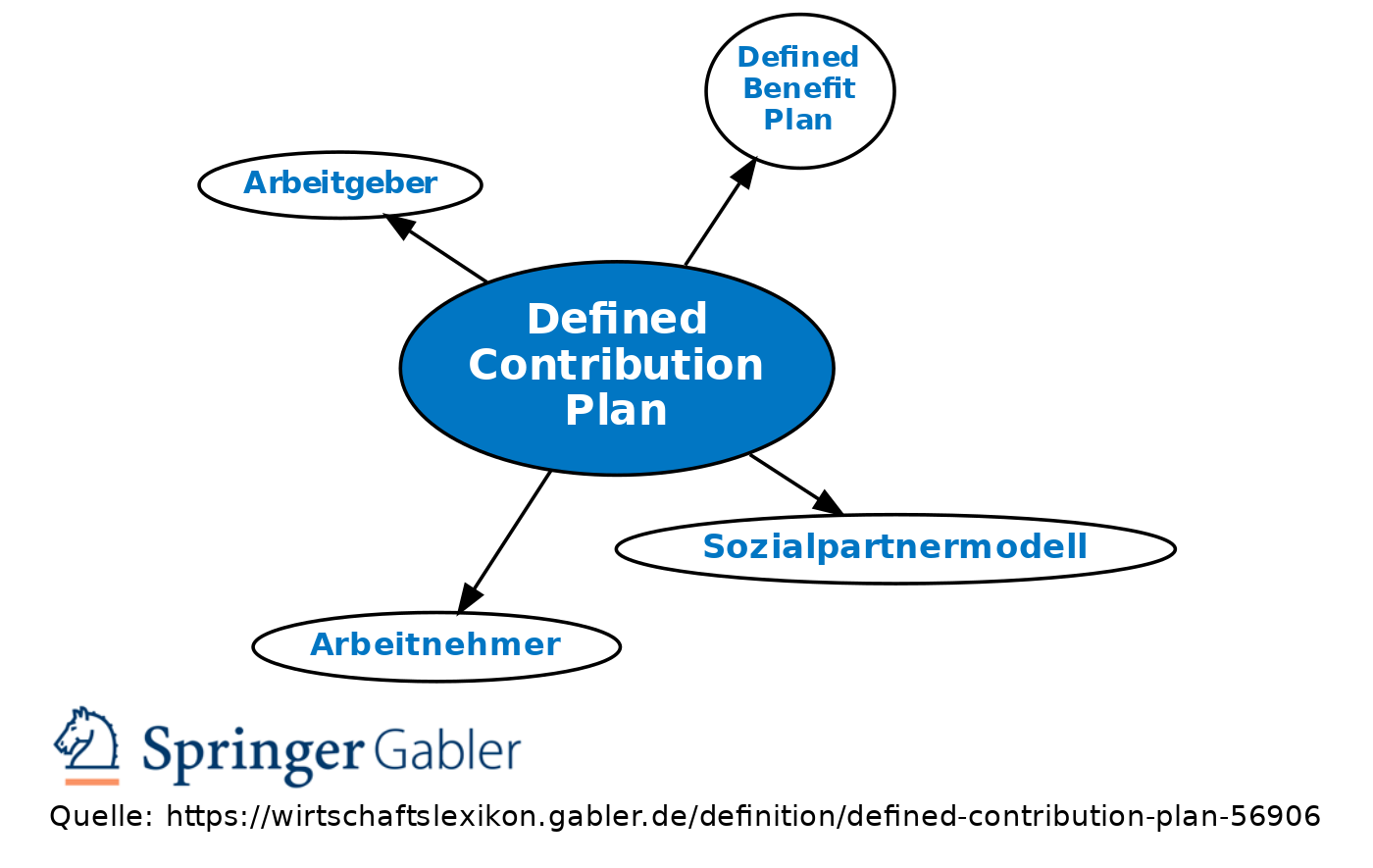

Pension plan definition. Your Raytheon Pension - The Association of Raytheon Retirees 07.09.2015 · Any pension plan is a set of promises to both the plan members and to the company sponsoring (and paying for) the plan. The promises to you consist of a definition of the pension the plan will pay you. The promise to the plan sponsor is the explicit understanding that plan’s definition is complete – and that the company is not required to fund any additional … en.wikipedia.org › wiki › PensionPension - Wikipedia A defined contribution (DC) plan, is a pension plan where employers set aside a certain proportion (i.e. contributions) of a worker's earnings (such as 5%) in an investment account, and the worker receives this savings and any accumulated investment earnings upon retirement. smartasset.com › retirement › what-is-a-pension-planPension Plans: Definition, Types, Benefits & Risks - SmartAsset Nov 03, 2021 · A pension plan is a type of retirement plan where employers promise to pay a defined benefit to employees for life after they retire. It’s different from a defined contribution plan, like a 401(k), where employees put their own money in an employer-sponsored investment program. Does Receiving A Pension Affect Social Security? - AARP 12.08.2021 · In the vast majority of cases, no. If the pension is from an employer that withheld FICA taxes from your paychecks, as almost all do, it won’t affect your Social Security retirement benefits.. If there was no such withholding, you may be subject to the Windfall Elimination Provision (WEP), which covers people who earned pensions from such "non-covered" jobs but …

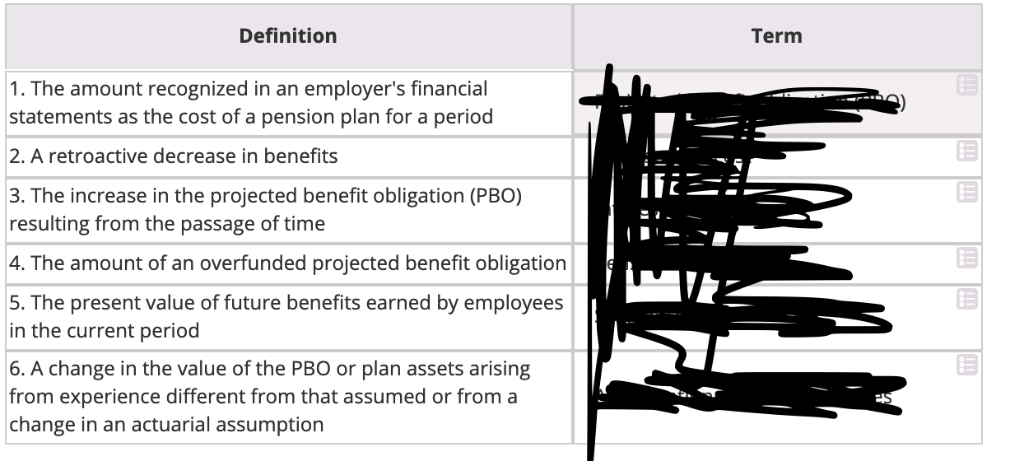

› 5 › 14Pension expense definition - AccountingTools Nov 18, 2021 · Pension expense is the amount that a business charges to expense in relation to its liabilities for pensions payable to employees. The amount of this expense varies, depending upon whether the underlying pension is a defined benefit plan or a defined contribution plan. The characteristics of these plan types are noted below. Defined Benefit Plan › dictionary › pensionPension Definition & Meaning - Merriam-Webster pension: [noun] a fixed sum paid regularly to a person:. wage. a gratuity granted (as by a government) as a favor or reward. one paid under given conditions to a person following retirement from service or to surviving dependents. › article › investingPension Plan vs. 401(k): Types, Pros & Cons - NerdWallet Jan 12, 2022 · A pension plan is a retirement-savings plan typically funded by an employer. Money goes into the pension on behalf of the employee while the employee works for the organization. The employee ... Publication 575 (2020), Pension and Annuity Income ... Under the pension plan, however, a formula determines the amount of the pension benefits. The amount of contributions is the amount necessary to provide that pension. Each plan is a separate program and a separate contract. If you get benefits from these plans, you must account for each separately, even though the benefits from both may be ...

/Balance_What_Happens_To_My_Pension_When_I_Leave_A_Job_2063411_V2-45fb62eb90d14d7c834a05988c0b4945.jpg)

/401k-retirement-plan-beginners-357115_FINAL2-430f125e634544fe80440a1cf026eafe.png)

/Balance_What_Is_A_Pension_And_How_Do_You_Get_One_2388766_V2-c977283a02f54f34ac6f31d018585830-ed6f412b721d4dfc85f6cac9184c78ab.jpg)

0 Response to "42 pension plan definition"

Post a Comment